Singapore continues to make strides toward digitalisation, and a key development in this journey is the GST InvoiceNow Requirement. This initiative, jointly driven by the Inland Revenue Authority of Singapore (IRAS) and the Infocomm Media Development Authority (IMDA), aims to streamline the way GST-registered businesses handle invoicing and tax compliance through a secure, standardised network known as InvoiceNow.

A. Introduction:

It is Singapore's nationwide e-invoicing network based on the global Peppol standard. Managed by IMDA, this infrastructure allows businesses to transmit invoices directly from one system to another in a structured digital format, ensuring greater efficiency, accuracy, and interoperability.

Since its launch in 2019, it has evolved significantly. Notably, in February 2024, it was upgraded with the PINT-SG Specification, enhancing its capacity for both cross-border transactions and alignment with GST submission requirements.

The requirement mandates the digital transmission of invoice data to IRAS via InvoiceNow-Ready Solutions. Businesses must ensure their systems can support this requirement, either through upgrades or by adopting pre-approved service providers.

B. Implementation Timeline:

| Phase | Date | Requirement Summary |

|---|---|---|

| Soft Launch & Early Adoption | 1 May 2025 | Voluntary adoption by existing and new GST applicants. |

| Initial Implementation | 1 Nov 2025 | Mandatory for newly incorporated companies applying for voluntary GST registration. |

| Full Implementation | 1 Apr 2026 | Applies to all new voluntary GST registrants. Certain exceptions apply. |

C. Types of invoice submission: There are four types

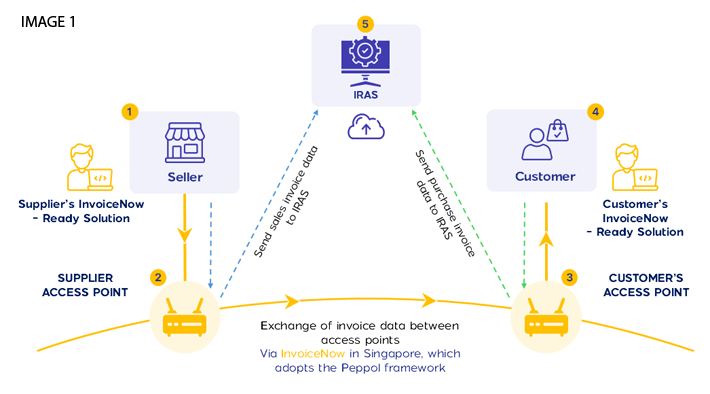

Supply Transaction made within InvoiceNow Network (i.e., Peppol Invoice) (refer IMAGE 1):

Supply transaction made by the supplier within the InvoiceNow network

For a supply transaction made within the InvoiceNow network (e.g., where both the GST-registered supplier and the customer are connected to IRAS via the InvoiceNow network), the transmission of the invoice data to IRAS occurs in the following manner:

- GST-registered supplier issues a Peppol invoice for a supply transaction using its InvoiceNow-Ready Solution via the InvoiceNow network and sends the invoice to its Access Point.

- IRSPs that have built in validation checks on wrongful GST charges would detect invoices from suppliers that wrongly charge GST and trigger an alert to the sender (i.e. the supplier) for his attention.

- Supplier's AP forwards the invoice to the customer's Access Point.

- Once the invoice data is successfully sent to the customer's Access Point, a copy of the Peppol invoice will be transmitted to IRAS automatically.

- Customer's Access Point forwards the invoice to the customer.

Corresponding Purchase Transaction received by the Customer within InvoiceNow Network from the Supply Transaction under Type 1A Submission (i.e., Solution-extracted Invoice) (refer IMAGE 1):

GST-registered customer receives, validates and accepts the invoice in its InvoiceNow-Ready Solution.

This would include indicating the appropriate GST Category Code(s) for purchases, the taxable purchase amount and input tax amount that the customer wishes to claim. The practice is in line with the typical process today when businesses record their purchases in their accounting systems.

A copy of the recorded purchase invoice is transmitted to IRAS by way of a Solution-extracted invoice through the customer's Access Point.

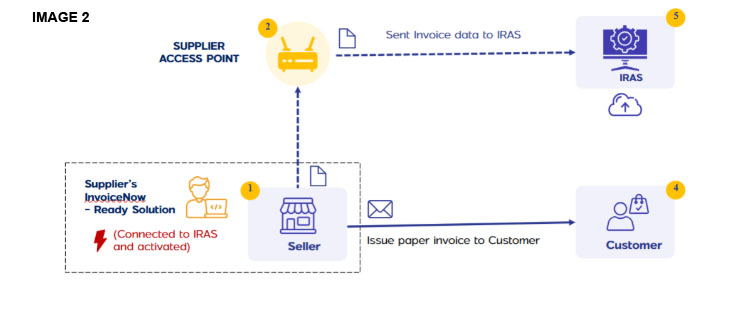

Supply Transaction made outside InvoiceNow Network (i.e., Solution-extracted invoice)

For a supply transaction made outside the InvoiceNow network (e.g., where the customer is not on the InvoiceNow network, or where the transactions are made using point-of-sale (“POS”) systems or to customers who are individuals), the transmission of the invoice data to IRAS occurs in the following manner:

(a) GST-registered supplier issues a paper / PDF invoice for the supply transaction to the customer and records the transaction in its InvoiceNow Ready Solution.

IRSPs that have built in the validation check on wrongful GST charges, which would help detect invoices from suppliers that wrongly charge GST and trigger an alert to the sender (which in this case is the supplier) for his attention.

(b) A Solution-extracted invoice for the supply transaction is submitted to the supplier's Access Point.

(c) Supplier's Access Point transmits the Solution-extracted invoice to IRAS.

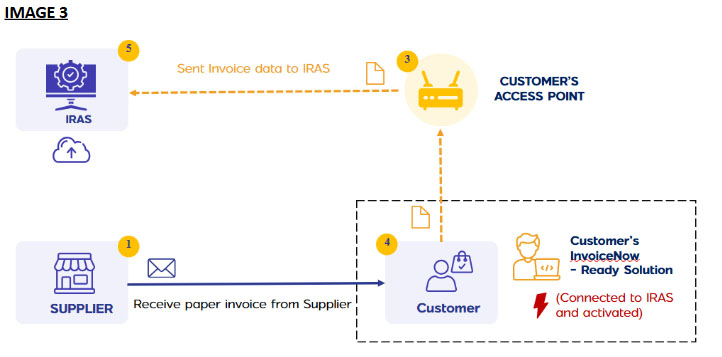

Purchase Transaction made outside InvoiceNow Network (i.e., Solution-extracted invoice)

For a purchase transaction made outside the InvoiceNow network (e.g., where the GST-registered supplier is not on the InvoiceNow network, or where the transaction(s) involve petty cash purchases (or PCPs), the transmission of the invoice data to IRAS occurs in the following manner:

(a) The GST-registered customer receives a paper/ PDF invoice for the purchase transaction and records the transaction in its InvoiceNow Ready Solution.

IRSPs that have built in the validation check on wrongful GST charges, which would help detect invoices from suppliers that wrongly charge GST and trigger an alert to the sender (which in this case is the customer) for his attention.

(b) The customer sends a Solution-extracted invoice for the purchase transaction to its Access Point.

(c) Customer's Access Point transmits the Solution-extracted invoice to IRAS.

D. Key Functional Highlights

Invoices must be sent via the InvoiceNow network or extracted from accounting systems and submitted to IRAS (Type 1A and 1B, 2 and 3).

IRAS is connected to the InvoiceNow network via an additional “fifth corner” in the traditional Peppol model, allowing for secure data submission through APIs.

Businesses must activate GST InvoiceNow Submission within their invoicing solution. Once enabled, IRAS receives copies of both issued and received invoices.

E.1. Data Schema Validation Check

GST-registered businesses and IRAS-Recognised Service Providers (IRSPs) are required to perform a data schema validation check before submitting invoice data to the Inland Revenue Authority of Singapore (IRAS).

This validation ensures that the submitted invoice data complies with the mandatory data elements and follows the expected XML format. To support this, IRAS provides Schematron files, which serve as rule sets that can be integrated into your system to automatically verify the structure and content of your invoice data.

It is important to note that IRAS does not perform validation checks between invoice-level totals and the sum of line-level amounts. This is due to variations in how business systems handle rounding. For example, some systems round amounts at the line level, while others apply rounding at the invoice level. As such, IRAS allows businesses the flexibility to manage rounding differences according to their own accounting practices

E.2. Recommendation to Implement GST Validation Check in InvoiceNow-Ready Solutions

IRAS strongly encourages IRSPs and GST-registered businesses to incorporate a validation check for wrongful GST charges into their solutions.

This validation feature uses invoice details—such as the supplier's GST registration number (GSTN), invoice date, and GST amount—together with data retrieved from the IRAS Check GST Register API to identify invoices that may have incorrectly charged GST.

Implementing this check will support smoother tax compliance and provide businesses with greater confidence that GST charges on incoming invoices are valid.

F. Benefits to Businesses

- Automated transmission reduces the manual burden of tax filing.

- Lower audit risks and faster GST refunds for compliant businesses.

- Real-time validation of GST numbers via IRAS APIs.

- Alerts for invalid GST charges or data inconsistencies.

- Potential for features such as pre-filing health checks and guided submissions by solution providers.

G. Applicable to Compliance Requirements

- Standard-rated, zero-rated, and exempt supplies

- Standard-rated and zero-rated purchases

- Excluded transactions (as defined by IRAS guidelines)

Invoices can be transmitted individually or in bulk (up to 10 per API call), and aggregated submissions are allowed for simplified tax invoices, petty cash purchases, and POS sales.

- Credit notes to correct prior invoices

- Adjustments without GST changes

- Foreign currency invoicing with SGD-converted figures

- Multiple line items with mixed GST treatments

Each scenario has specific requirements for submission to IRAS, including reference to original invoices and proper coding of adjustments.

H. Mandatory Data Elements

All invoice data must include specific fields such as GST registration number, invoice date, amounts, and GST codes. For non-Peppol submissions, the words “Tax Invoice” must be shown on the document unless otherwise exempted.

- Service Interruptions: API retries are built-in, and backup submission plans should be in place.

- Data Matching: Businesses must reconcile IRAS-submitted data with their GST returns, considering timing and reporting exceptions.

- Group and Divisional Registrations: Specific rules apply depending on business structures and representative member setups.

To ensure timely compliance, businesses should:

- Engage with IRAS-registered solution providers (IRSPs) or Access Points (APs)

- Activate the InvoiceNow functionality within their software

- Educate internal teams on new data and submission requirements

- Plan for testing and phased rollouts ahead of mandated deadlines

Conclusion

The GST InvoiceNow Requirement is a pivotal step towards digital tax compliance in Singapore. By adopting this system early, businesses not only ensure regulatory adherence but also unlock operational efficiencies, cost savings, and better financial management.

How can we help?

Anusaar is a certified Peppol Access Point, equipped to support businesses in seamlessly integrating and automating electronic invoices and other business documents. With extensive experience in integration and automation, our team of seasoned professionals offers expert assessment and gap analysis to identify your specific needs. We provide tailored solutions designed to enhance efficiency, ensure compliance, and streamline your invoicing processes. Let us help you navigate the path of Singapore e-invoicing with ease.